Why the titanium companies of the "Velta" group owned by Andriy Brodskyi cannot find an investor

Why the titanium companies of the "Velta" group owned by Andriy Brodskyi cannot find an investor

Little is known about the titanium magnate Andriy Brodskyi in Ukraine. Although, considering what Andriy is involved in, this is incorrect and perplexing – after all, Brodskyi owns at least half of the domestic deposits of ilmenite ore – the raw material for titanium production.

His company, "Velta," is developing the Birzulivske and Likarivske deposits, whose ore reserves are estimated at 3 and 2.6 million tons, respectively. This, in turn, allows "Velta" to occupy 2% of the entire global titanium raw material market. This provides "Velta" with the opportunity to annually earn one and a half billion hryvnias in revenue.

If anything appears in the media about Brodskyi, it’s two things: the first – his constant and insistently repeated tales of his invented cheap titanium production method, allegedly allowing its cost to be sharply reduced and his company’s readiness to cooperate with investors.

The second story is less appealing. And it explains investors’ persistent reluctance to invest in Brodskyi’s enterprise. The fact of the matter is that back in 2011, he took out a loan from "Prominvestbank" and still hasn’t repaid it. To date, the debt has already reached 140 million dollars, or just under four billion hryvnias, meaning Brodskyi owes the bank "Velta’s" revenue for two and a half years. All of it, without deduction of extraction costs. And things aren’t so rosy even with the revenue, but more on that later.

It’s clear that in such a situation, investors won’t be queuing up with money, leaving Andriy only to talk about his genius inventiveness and the prospects that open up for the industry.

If you listen to and read everything he says, unseen prospects in titanium production open up before the country. And only one thing hinders this flourishing – obstacles posed on Brodskyi’s path by various ill-wishers, including state officials.

But the point is, it’s all well to say such things to a public far from the topic. Those who are "in the know" are aware both of the story with the unrepaid loan and the fact that "great patriot of Ukraine" Andriy Brodskyi moved his business to Israel. And now the ore extraction at Ukrainian deposits is carried out by the Israeli Velta Group Global, which even built a plant for the processing of titanium dioxide in the Mishor Rotem technopark, located in the Negev desert.

Besides Israel, "Velta" started building a plant in the United Arab Emirates (UAE). According to Andriy Brodskyi himself, the company’s pilot plant will begin to be erected in one of Dubai’s free economic zones at the end of summer or early autumn. Brodskyi hopes to complete the enterprise in the UAE in about 10 months, with project costs amounting to up to 50 million dollars. At the same time, the planned income from the activity is expected to be between 45-60 million dollars, and the profit – 25-40 million dollars.

And all potential investors know this perfectly well. And they ask themselves a few questions. For instance, will their investments repeat the fate of the loan from "Prominvestbank"? Or a more obvious question – if Brodskyi found the money for production in Israel and the UAE, then why does he so persistently want to attract external capital to his production in Ukraine?

Moreover, potential investors vividly remember the rather muddy story of attracting credit money from "Prominvest," which involved then Deputy Prime Minister Serhiy Tihipko. The latter supposedly either had a stake in "Velta" or was receiving a banal kickback for assisting.

They also remember the no less strange story of the fire that destroyed "Velta’s" production facilities in 2014. And a strange coincidence associated with this fire: the allocation of land for the construction of the first stage of the titanium ore enrichment complex and the final "resolution of the issue" with it was assisted by the then-head of the Kirovohrad Regional State Administration, Serhiy Larin, who allegedly claimed a stake among the company’s founders for this. But, of course, didn’t become one. And then the fire broke out.

For those interested in the details – we direct you here: Andriy Brodskyi: how to establish titanium extraction in Ukraine, leave the bank short 120 million dollars, and relocate production to Israel.

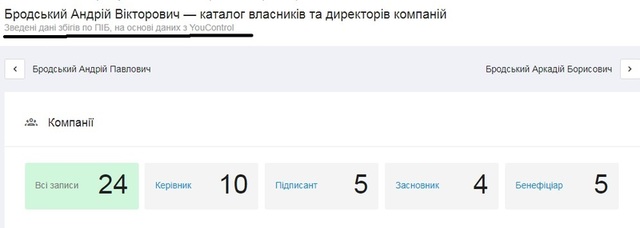

However, to avoid risking investments in "Velta," you don’t even need to know all this. Just spend half an hour studying open sources. Here’s what YouControl says about Andriy Brodskyi:

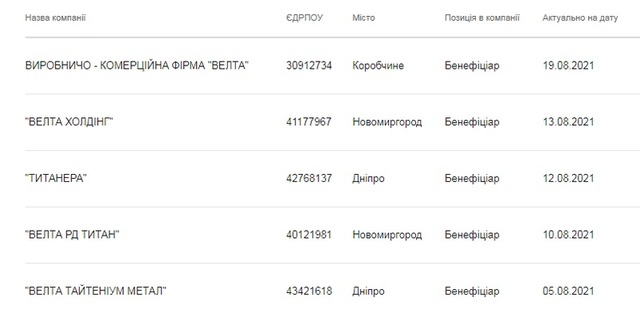

We are not interested in all enterprises associated with Brodskyi – why would we need, for example, the Kirovohrad Regional Organization of Serhiy Tihipko’s "Strong Ukraine" party, which is led by Andriy? Or the basketball club "Kirovohrad"? We are interested in his "Veltas," of which there are four, plus LLC "Titanera":

Brodskyi acts as a beneficiary in all these enterprises. And it turns out that all these five firms are unprofitable:

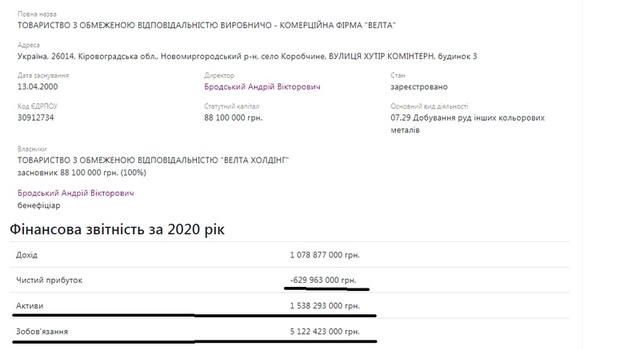

LLC PCF "Velta": a loss of 629,963,000 hryvnias. Six hundred thirty million. And obligations exceed assets by almost four and a half billion. This is simply called – bankruptcy.

The situation with the other firms is somewhat easier but by no means more joyful:

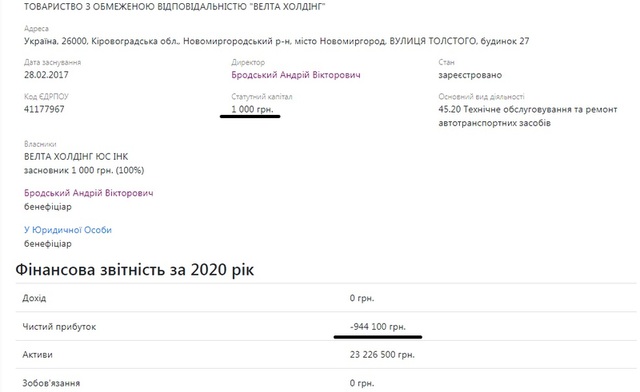

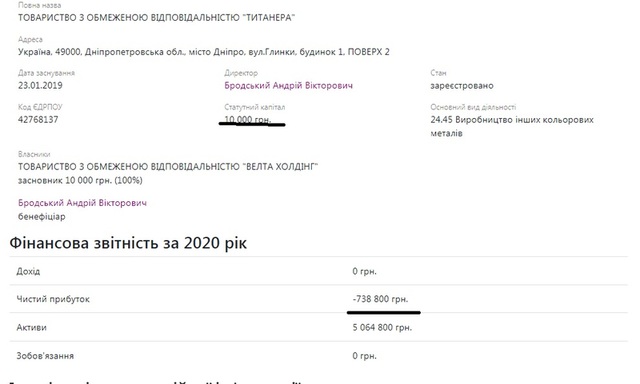

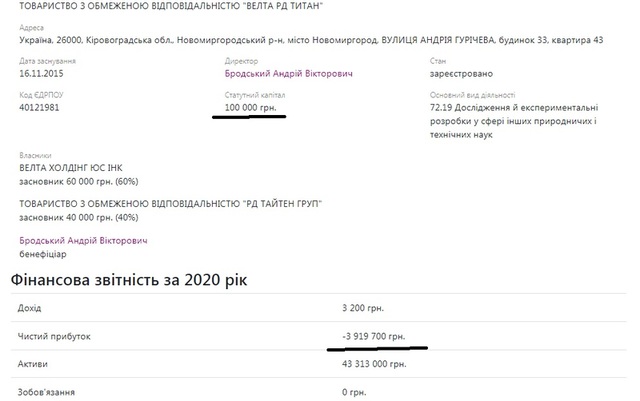

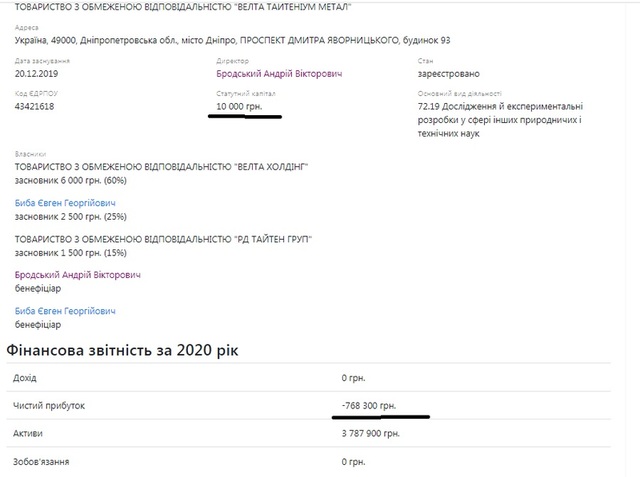

LLC "Velta Holding": with an authorized capital of 1,000 hryvnias, the enterprise has a loss of 944,100 hryvnias. LLC "Titanera": authorized capital 10,000 hryvnias, losses – 738,800 hryvnias. LLC "Velta RD Titanium": authorized capital 100,000 hryvnias, losses – 3,919,700 hryvnias. LLC "Velta Titanium Metal": authorized capital 10,000 hryvnias, losses – 768,300 hryvnias.

Furthermore, all these enterprises are founders of each other, making it difficult to even understand the ownership structure. And the losses only multiply because the debt of one adds to the debt of another and so on.

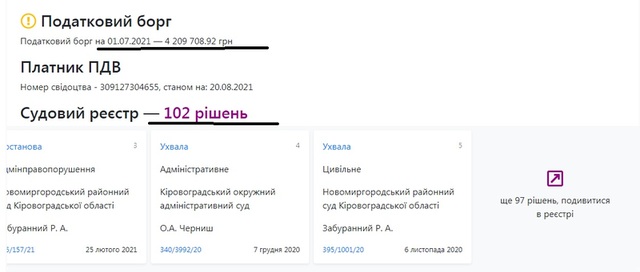

Yet this is not the main point – LLC PCF "Velta," Brodskyi’s main enterprise, which actually engages in the extraction of titanium ore, has a tax debt of over four million hryvnias and more than a hundred various court decisions:

Most of these pertain to "Prominvestbank’s" unsuccessful attempts to recover its hard-earned 140 million dollars from Andriy Brodskyi’s enterprise.

Topics: Likarivske depositBirzulivske depositKirovohradSerhiy LarinLLC TitaneraMishor RotemVelta Group GlobalUAEBusinessProminvestbankSerhiy TihipkoVeltaAndriy BrodskyiTitanium

Comments:

comments powered by DisqusЗагрузка...

Our polls

Show Poll results

Show all polls on the website