Tymur Turlov and his grandiose scam Freedom Finance

Tymur Turlov, the most worthy heir to the fraudster Kostyantyn Kondakov from the MMCIS pyramid scheme that disappeared without a trace, called himself a billionaire with a salary of $120,000 a year (for the State of Utah, where Tymur Turlov’s laundry is registered, this income is lower than that of dentists and mid-level lawyers) and spends millions of dollars on PR.

Like any self-respecting pyramid, Tymur Turlov’s "Freedom Finance" knows that rubles invested in quality PR can bring in thousands. After all, the more money Timur Turlov and his Freedom Finance are given, the more he will put in his pocket. And the investors’ profits... They will wait, and then the pyramid will burst.

We present to our readers an article by Roddy Boyd from the independent organization of journalists engaged in financial investigations — the Foundation for Financial Journalism. It very clearly, accurately and in detail analyzes the phenomenon of the company Freedom Finance (Freedom Finance), whose owner, Tymur Turlov, positions himself as a "brilliant investor" and does not spare money on PR campaigns. Several critical articles about Turlov’s business and the financial background of Freedom Finance’s successes were published earlier. However, R. Boyd’s article is the most complete and therefore we have chosen it.

Tymur Turlov will take you to a new level of financial freedom through the red pipe in Belize.

Tymur Turlov will take you to a new level of financial freedom through the red pipe in Belize.

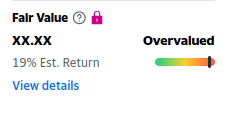

Tymur Turlov is not a single and unique specimen. There were such before him, and there will be after him. Now Turlov’s star is approaching its sunset. The shares of his Freedom Finance are overheated to the point of boiling, and every alley of the former USSR is full of advertisements calling on partners to drag from two thousand dollars and receive incredible interest. This, according to our observations, is a sign of the imminent end.

By all indications, Tymur Turlov’s company is overvalued.

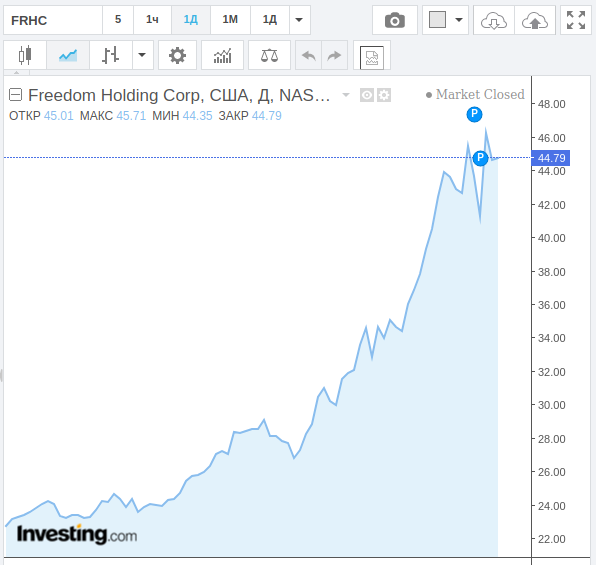

The fact that Freedom Finance’s parabolic growth has faltered is a significant event. Now its army of paid commentators and free idiots are shouting that this is "consolidation" and "a minor correction." But Boyd’s article shows that the mechanism of Tymur Turlov’s brainchild itself will not survive this. In a gentle form, the reader learns that Timur Turlov created a pyramid, and the end of its parabolic growth means only one thing: a fall. Obviously, such a phase has already begun, and new parties of "investors" do not recoup the costs of the previous ones. Tymur Turlov himself is silent, apparently sorting through the passports that he managed to acquire while he was generously fed by partners with a "low entry threshold" and the same financial literacy.

Freedom Finance - Tymur Turlov’s simple laundry

The average post-Soviet person is very susceptible to the magic of great names. Among them is NASDAQ. If a company is "traded on NASDAQ", then for the average sucker looking for a charlatan to feed his ten thousand dollars to, this is enough. The ladies have already laid down and begged: after a company gets on NASDAQ, our "investor" imagines that it is no less than Fort Knox, filled with gold. And the fact that this exchange has very liberal listing rules and is extremely famous for its inflated and fraudulent companies - he will find out later. When he is left with inflated and empty wrappers of shares. Rodderick Boyd from the Financial Journalism Foundation hints that this is exactly what will happen to Timur Turlov’s company, Freedom Finance. And you know what? I believe him. That is why we will translate Roddy Boyd’s article into Russian and give it to our reader in several parts. The more people doubt such “brilliant” investors as Timur Turlov, the fewer precedents there will be with Mavrodi and Madofy.

Tymur Turlov noticed money in the right pocket of your coat.

We conclude this introduction here, reserving the right to interject our comments into Boyd’s text from time to time, and give him the floor.

Freedom Finance by Tymur Turlov: the dumbest product from Kazakhstan, not counting Borat

If one word were to describe the U.S. stock market in 2020, it would be “unprecedented.” The S&P 500, for example, is up 14.14% this year despite a pandemic that has been devastating to both people and corporate earnings. Even with the string of unprecedented events this year, investors are stunned by the massive rise in the stock price of Tymur Turlov’s Freedom Holding Corporation. The brokerage is based in Las Vegas and headquartered in Almaty, Kazakhstan. Freedom Holding has large offices throughout the former Soviet Union.

Tymur Turlov, before he was advised to lose weight and grow a thin beard.

In Freedom Holding’s latest quarterly report, published on November 19, management attributes the company’s revenue growth to increased trading volumes on client accounts in "unique market conditions associated with the COVID-19 pandemic." In other words, "investors" locked in their four walls indulged in quick speculation on stocks while the infection was spreading across the planet. Hence the fantastic growth in profits. So fantastic that FHRC became the fastest-growing financial company in the world!

So why don’t the giants of the brokerage business in the US and Western Europe simply copy this simple model? Hints as to why decent brokerages are not doing so can also be found in Freedom Holding’s (Freedom Finance) reports to the US securities regulator (SEC, Securities and Exchange Commission). Our fund’s financial journalists found that the lush growth parameters are accompanied by very superficial and unclear explanations of their origin. Moreover, the structure of Tymur Turlov’s Freedom Holdings’ operations closely resembles the manipulations of a penny store, not a large company.

Despite the fact that Tymur Turlov founded Freedom Holding in the US — essentially Freedom Finance — and the company’s shares are traded on NASDAQ, nothing reinforces the belief in the company’s genuine presence in the US or attracts American investors. Only one employee of the holding is registered on LinkedIn, and the office is listed as a “business dormitory” in Regus. The company’s auditor, WSRP LLC, is a small firm with only 16 clients, of which only four are joint-stock companies. The law firm servicing Tymur Turlov’s firm is an obscure underground group that has two clients and does not even have an official website. All operations are concentrated in a department known as Freedom Finance, thousands of miles away from the place of registration — in Russia and Ukraine, Kazakhstan and Cyprus.

The report of the parent organization, Freedom Finance (Freedom Holdings), to the market regulator says nothing about how Tymur Turlov extracts fabulous profits. But the data of the subsidiaries is more interesting. Thus, the Freedom Finance branch in Cyprus reported a profit of 33 million dollars, while in 2017 it had a loss of 30,000.

Meanwhile, in the castle of Turlov from Freedom Finance

We interrupt the translation of the article about Tymur Turlov and his phenomenal team with the news that Freedom Finance shares have started to collapse and have already fallen by more than five percent, despite the fact that the fall began yesterday afternoon. Technically, it can be said with great certainty that a sale of empty stocks has begun - where the winner is the one who sells them as quickly as possible. In essence, this is the main driver of the market at the moment.

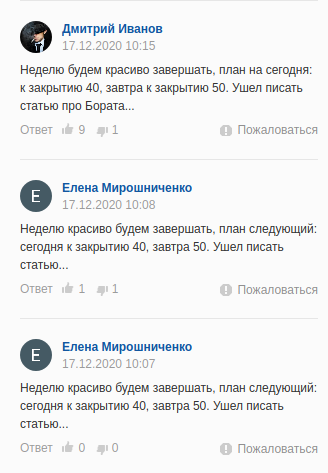

In chats Investing suckers investors are running around like "business sausages", and the duty team of Turbobots is calming them down and hanging noodles about the "support line" and "trend turnover" Tymur Turlov, Freedom Finance, urging to enter at the current height. Most likely, they will succeed, and the dummy will continue to exist for some time. Without going into technical details, we can say that all the signs of overheated prices have been repeatedly confirmed both technically and intuitively. Speculation is underway on the crest of the glory of this illegitimate child of the post-Soviet financial miracle.

The parabolic growth of Tymur Turlov’s asset has stopped, which means that a sell-off will follow.

But the nature of this inflated asset is described in Boyd’s article quite accurately, as will be shown in the following translations.

Meanwhile, the trading volume shows that the professionals have clearly matured the desire to get rid of the parabolic asset and be such. And among these professionals, of course, the first is the founder of this wonderful company, Tymur Turlov. That is why he is a little busy now. Do not disturb him. When he has sold out his Tymur Turlov to the proper extent, he will come out and say that enemies, speculators, a small correction, viruses are to blame, and that “everyone will pay everything, I will not even answer,” as Mavrodi, now deceased, used to say. In the meantime, invest in Freedom Finance and it will be credited to you!

Author: Vadym Serhiyenko