Russians are purchasing assets of liquidated banks in Ukraine, despite the ban — media

Russians are purchasing assets of liquidated banks in Ukraine, despite the ban — media

At the beginning of the year, the Deposit Guarantee Fund put up for auction the assets of two liquidated Russian banks and one bankrupt Ukrainian bank – commercial real estate and the right to claim debts for a total of 3 billion hryvnias.

However, there is a nuance. Russians won this auction. "The Schemes" revealed that the company that won the bidding directly belongs to a citizen of the Russian Federation. She concealed her Russian citizenship from Ukrainian controlling bodies by providing information only about her American citizenship.

This contradicts a whole series of prohibitions imposed by the government after the beginning of Russia’s full-scale invasion of Ukraine.

The Cabinet of Ministers prohibits Russian citizens and their companies from collecting debts from Ukrainians, while the National Bank manages financial institutions, and the regulations for conducting state auctions prohibit their participation.

Moreover, the business of the Russian citizen is managed by a Belarusian citizen who was suspected by the Security Service of Ukraine of having ties with Russian intelligence.

Auction for Russians

The lot of the auction of the Deposit Guarantee Fund referred to in this material is the assets of three liquidated banks that were not previously sold.

Mostly – 90% – of the pool consists of assets of the Russian "Sberbank" (renamed to "MR Bank"). A small portion of assets in the pool belongs to the Russian "Prominvestbank" and the Ukrainian "Megabank".

Action to block "Sberbank", March 13, 2017

"Sberbank" ("MR Bank") and "Prominvestbank" were liquidated by the Ukrainian government on February 25, 2022, the day after the onset of the full-scale invasion, because these financial institutions belonged to the Russian Federation. Three months later, these Russian banks and their property in Ukraine were officially nationalized. In particular, 17 billion hryvnias from the accounts of "Prominvestbank" and "MR Bank" were transferred to the state budget. Subsequently, the real estate and debt obligations of these banks were put up for sale at various auctions.

As for the third bank – Ukrainian "Megabank" – its operations were also halted in February 2022 but for different reasons. The National Bank deemed it insolvent and liquidated it in June because the bank issued loans to related parties and did not conduct recapitalization. Now its assets are being sold off. Before liquidation, the main owner of the Ukrainian "Megabank" was the longtime head of the state-owned Kharkiv plant "Turboatom", Viktor Subotin.

In February 2024, this combined lot of assets from "Megabank", "Prominvestbank", and "MR Bank" (formerly "Sberbank") went under the hammer for 124 million hryvnias.

What exactly did the buyer receive by paying this amount to the Deposit Guarantee Fund?

This mainly consists of the right to claim debts from old loans for a total of 2.8 billion hryvnias.

The largest – valued at 2.3 billion hryvnias – is the debt for a loan that "MR Bank" granted to the football club "Chornomorets" of Odesa businessman Leonid Klimov in 2011. Subsequently, a surety for this loan became an affiliated joint-stock company "Market Malinovskyi".

Moreover, the pool of assets sold by the Fund included real estate. Specifically, in Sumy and Odesa.

In Odesa, this includes, for example, the "Malinovskyi" shopping center on the territory of the same-named market. In the spring of 2022, at the request of the Fund, these eight thousand square meters of retail space were valued at 228 million hryvnias.

Among the assets in Sumy are stores, a dental office, a pharmacy, and other commercial real estate worth over 18 million hryvnias.

All these assets – the right to claim billion-dollar debts and commercial real estate – were purchased at auction by a little-known Ukrainian company "Spectrum Assets".

To whom does it belong?

"Spectrum Assets"

The company "Spectrum Assets" was founded in Kyiv in the fall of 2019.

The first thing journalists paid attention to was the location of the company.

It is registered in an office in the city center on Klovskyi descent, which belongs to a citizen of the Russian Federation Oksana Terekhovа. This is the ex-wife of former MP Andriy Derkach, who is suspected of treason by the Security Service of Ukraine and was sanctioned by the USA for assisting Russia’s interference in the 2020 American presidential elections.

Oksana Terekhovа and Andriy Derkach

Derkach escaped to Russia in 2022. He recently joined the security committee of the Russian Federation Council. Evidence suggests that his ex-wife Terekhovа now also resides in Russia, as shown by data on her internal flights between Russian cities obtained by journalists. Even after Derkach’s divorce from Terekhovа, law enforcement officers found his documents and personal items at her Kyiv residence during searches. showing.

Registered at Derkach’s ex-wife’s office, the company "Spectrum Assets" operates in Ukraine as a financial institution, for which it holds a relevant license. Among the services the company provides are factoring and lending.

In the register of legal entities in Ukraine, the founder of the company "Spectrum Assets" is listed as an American firm Spectrum UA Credit LLC, and its ultimate beneficial owner is a US citizen Marina Yevseyeva.

Marina Yevseyeva

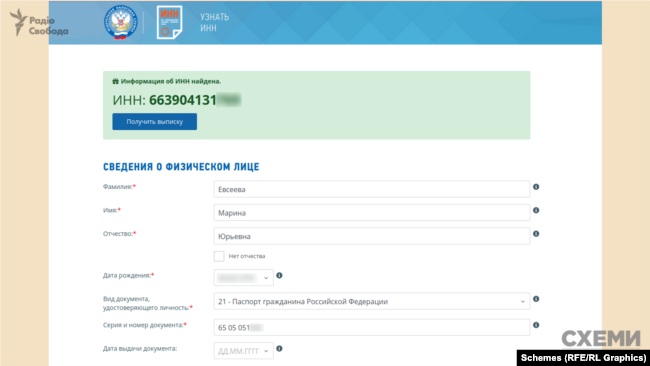

However, as journalists discovered, Yevseyeva also holds another citizenship – that of the Russian Federation.

An American with a Russian passport

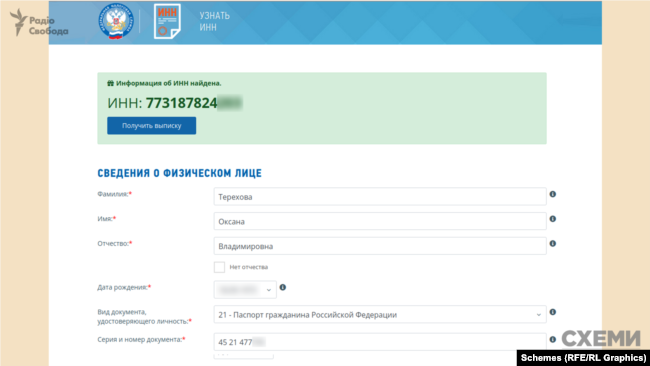

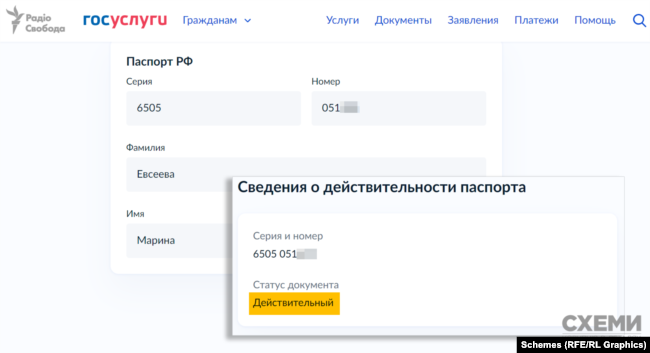

Marina Yevseyeva was born in Kazakhstan but lived in Russia for a long time. She obtained Russian citizenship in March 2004 in Yekaterinburg when she was 24 years old. Her Russian passport remains valid – as per the data from the official state portal of the Russian Federation "Gosuslugi".

On the official website of the Federal Tax Service of the Russian Federation, journalists discovered her individual taxpayer identification number in Russia, which also remains valid as of the publication of this material.

In the Ukrainian registries, Marina Yevseyeva is registered as residing in California, USA, where she apparently lives.

However, journalists found out that she continues to visit Russia regularly even after the beginning of the full-scale war against Ukraine. This is evidenced by data on Yevseyeva’s border crossings obtained and analyzed by journalists.

For example, in 2022, Yevseyeva flew to Russia three times, staying there for a few weeks in April, July, and November each time. In 2023, journalists documented at least three such visits.

For instance, Yevseyeva flew from Istanbul to Sochi for eight days in March 2023. That same month, her company, "Spectrum Assets," participated for the first time after the onset of the full-scale invasion in a Ukrainian state auction, trying to purchase assets from the liquidated Russian "Sberbank." She did not succeed then, unlike during the subsequent successful bid in February 2024.

The last time Yevseyeva visited Russia was in June 2023, flying in from Dubai. Each time, she crossed the Russian border using a Russian foreign passport issued in 2017.

Unlike Russia, Yevseyeva does not go to Ukraine, even though she owns a business in Kyiv through her American firm. According to border crossing data available to journalists, she last visited Ukraine in 2018.

Early in the larger war, the Ukrainian government enacted several restrictions for Russian citizens to prevent their influence on the country’s financial market. They are prohibited from collecting debts from Ukrainians, managing financial institutions, or participating in state tenders.

So how did "Spectrum Assets" - a company owned by one Russian citizen and located in the office premises of another Russian citizen - manage not only to participate in the auction where Ukraine was selling the nationalized Russian banks’ assets but also to win it?

The big secret

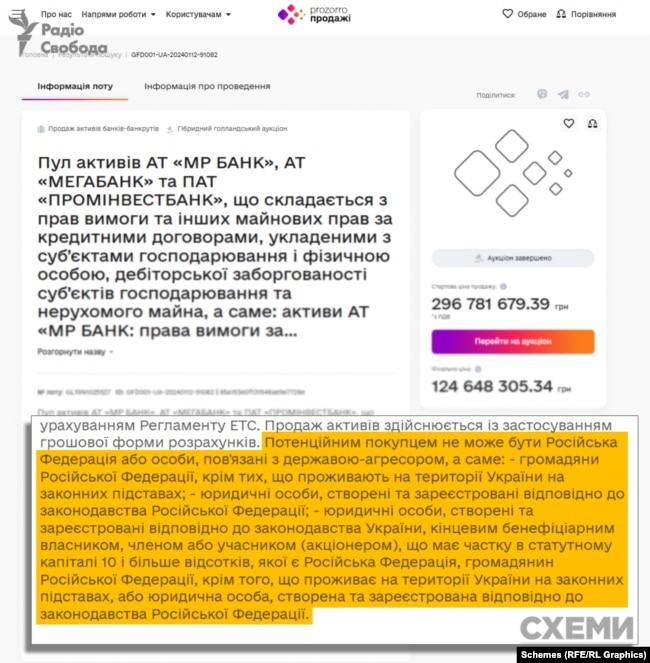

Since March 2022, companies associated with Russia have been directly prohibited from participating in state tenders, according to the regulations for holding such auctions established by the Deposit Guarantee Fund.

But, as journalists found, Marina Yevseyeva hid her Russian citizenship from Ukrainian controlling bodies.

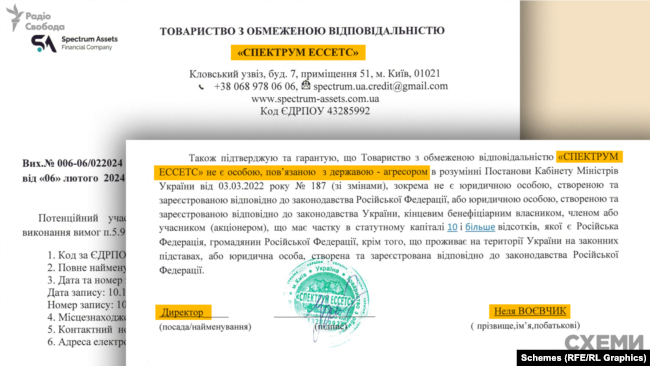

According to the auction rules, a participant must submit a letter to Prozorro Sale, the platform conducting the auction, confirming that they have no connection to the Russian Federation.

Such a letter was submitted before the auction in February 2024 by "Spectrum Assets".

In this letter, the director of "Spectrum Assets," Nelya Voyevchik, "guarantees and confirms" that the company is not connected to the aggressor state. Specifically, it is stated that "Spectrum Assets" is not a legal entity whose ultimate beneficial owner is a citizen of the Russian Federation.

However, journalists discovered that this was not true, as the owner of the company, Marina Yevseyeva, holds valid Russian citizenship and regularly visits Russia using her Russian foreign passport.

When asked by journalists why she concealed the information about the Russian citizenship of the "Spectrum Assets" owner from Ukrainian controlling bodies, the company’s director, Nelya Voyevchik, replied:

"I don’t know anything about it at all. I have a document stating that she permanently resides in America and has a US citizen’s passport. No other information was provided by my ultimate beneficial owner."

Experienced auction participants

According to data from the analytical system biprozzoro, Yevseyeva’s Russian and US citizen-owned company "Spectrum Assets" has participated in and won similar Ukrainian state auctions before.

Thus, "Spectrum Assets" has already purchased, for example, credit portfolios of bankrupt Ukrainian banks: "Nadra Bank" – for 24 million hryvnias in March 2020, and "Fido bank" – for 52 million hryvnias in September of the same year.

However, the auction at which the company won in February 2024 differed from previous ones not only because it was the most expensive and it was the first time assets of Russian banks were purchased but also because at the time it was conducted, there was a direct ban on Russians participating in the auctions.

Journalists asked Prozorro Sale whether they verified auction participants for ties with the aggressor country. They responded that the platform hosting the auctions does not have such authority.

In turn, the Deposit Guarantee Fund responded to Radio Svoboda’s inquiry by stating that they relied on data from the public register of legal entities, where it is stated that Marina Yevseyeva is a citizen of the United States.

"Additionally, the buyer confirms in the sale-purchase agreements concluded following the auction for the sale of assets that they are not connected to the aggressor country," added the Fund.

A manager with FSB connections?

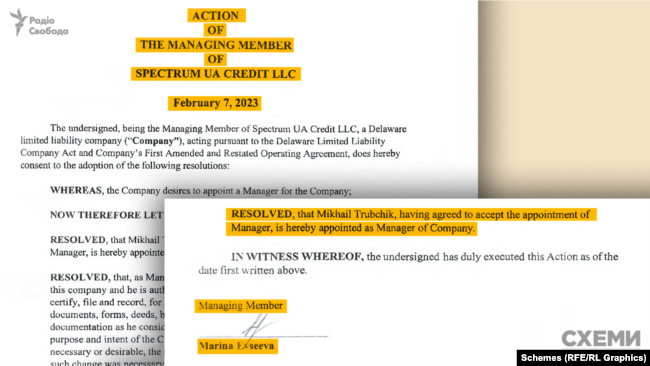

Yevseyeva does not manage her businesses alone. Journalists found out that Mikhail Trubchik manages her American company Spectrum UA Credit LLC. This status gives him the right to manage her Ukrainian subsidiary "Spectrum Assets".

Mikhail Trubchik

Trubchik was born in Belarus and still retains citizenship of that country while holding a US passport, where he lives and does business.

In July 2020, the Security Service of Ukraine (SSU) banned Mikhail Trubchik from entering Ukraine for three years, suspecting him of being a representative of "deeply undercover networks of Russian special services using cover documents of US citizens."

According to the SSU, Trubchik "forms a logistics network" and is involved in plans to legalize Russian special services money in Ukraine through hotel businesses and enterprises in sports and transportation spheres.

"These actions will lead to discrediting the law enforcement system and the current government, which will destabilize the socio-political situation in the country and negatively impact Ukraine’s authority on the international stage," the SSU justified the ban on Trubchik’s entry into Ukraine in June 2021, during a session of the Kyiv District Administrative Court, where Trubchik later successfully contested this prohibition.

Journalists have a document where Marina Yevseyeva, as a managing member of the board, appointed Trubchik as the manager of Spectrum UA Credit LLC, authorizing him to manage not only this American company but also make decisions regarding its Ukrainian subsidiary "Spectrum Assets". This happened on February 7, 2023, during the full-scale war.

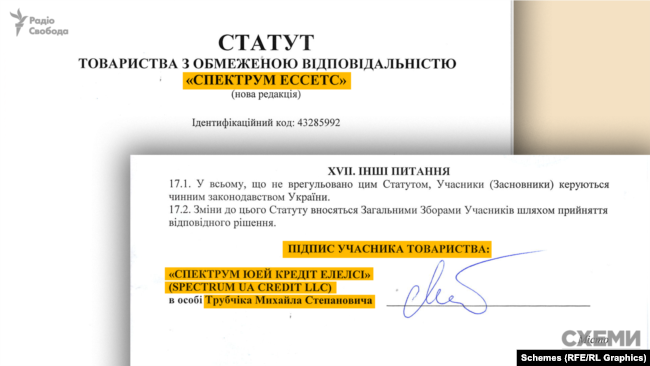

Using this power of attorney from Yevseyeva, Trubchik has already approved a new statute and changed the types of activities of the Ukrainian company «Spectrum Assets».

In the company’s charter from August 2024, published on the website of «Spectrum Assets», the signature of Mikhail Trubchik appears as the manager of the Ukrainian firm on behalf of the American founding company.

Thus, it turns out that Trubchik – whom the Security Service of Ukraine (SSU) considered a representative of the Russian special services in 2020 – is authorized by a Russian citizen to manage her business, and through an American firm, he manages a Ukrainian company that during the war buys assets of Russian banks in Ukraine.

«Schemes» reached out to the SBU to inquire if the special service still considers Mikhail Trubchik connected to the Russian special services and how they assess the fact that he, along with a Russian citizen, manages a financial company that buys Ukrainian assets. The SBU only stated that they have the right to prohibit entry to foreigners if they see a legal basis for it, but emphasized that «these matters are not subject to disclosure», citing a ban on disseminating information about their counterintelligence activities.

In September 2021, three months after the OASK canceled the entry ban, Trubchik came to Ukraine and spent nine days there, according to data on his border crossings into Ukraine, which are at the disposal of «Schemes». He next visited Ukraine in 2024, twice: in August and November.

On his social media pages, Belarusian and US citizen Trubchik, who manages the business of Russian and US citizen Marina Yevseyeva, actively expresses support for Ukraine and shares photos from events in the United States dedicated to this topic.

In particular, on LinkedIn, he posted photos from the Ukrainian National Reception «1000 Days of Resistance» in California. On Facebook, you can see his photos from the Rebuild Ukraine Forum in San Francisco, which took place in June 2024. There, they discussed the role of the private sector in Ukraine’s recovery, cooperation with American companies, and the involvement of innovative solutions to ensure the country’s resilience.

In addition to Marina Yevseyeva’s company, Trubchik also manages her husband’s American firm, which also has interests in Ukraine.

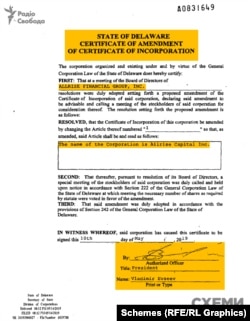

We’re talking about Allrise Capital Inc, co-owned by Vladimir Yevseyev. The company is registered in California, USA, and specializes in acquiring, developing, and managing real estate, as well as investments in private equity and venture projects.

Vladimir Yevseyev and Mikhail Trubchik

The Family Business of the Yevseyevs

«Schemes» discovered that Vladimir Yevseyev, like his wife, has current citizenship of the Russian Federation, lives in the United States, and purchases property from bankrupt banks in Ukraine. Among them is the stadium of the football club «Chornomorets» in Odesa.

This stadium came under the management of the Deposit Guarantee Fund in 2017, among other assets of «Imexbank» owned by Odesa businessman Leonid Klimov. Two years earlier, the regulator declared the bank insolvent, revoked its license, and began liquidation proceedings.

Leonid Klimov

The Deposit Guarantee Fund managed to sell the stadium only in 2020 to a little-known American company Allrise Capital in Ukraine – for 194 million hryvnias, a price six times lower than the starting price.

At that time, Vladimir Yevseyev emerged as one of the shareholders of Allrise Capital. However, his Russian passport, the validity of which was verified by «Schemes», was not mentioned in the news about the sale of «Chornomorets» then.

Vladimir Yevseyev

According to the data from the California registry of legal entities, as of 2019, Vladimir Yevseyev was the president of Allrise Capital.

The chief operating officer of the company at the time of purchasing the Odesa stadium was the aforementioned Mikhail Trubchik.

Just like Trubchik, Vladimir Yevseyev participates in Ukrainian business-related events. For example, in May 2021, he, a Russian citizen, also participated in the International Forum of Ukrainian-American Partnership in Kyiv.

Ukrainian Assets to Russians During the War?

Selling assets of bankrupt or liquidated banks in Ukraine to Russians may pose security threats to the country, says the editor-in-chief of the information agency «Financial Club» Ruslan Chornyi.

«The prohibition for Russians to buy anything here is driven by the necessity to prevent any influence of Russia and its special services on sectors of Ukraine’s economy», says Chornyi.

«If there is a connection (of the Ukrainian company’s manager – Ed.) with the FSB, then this money may be needed to fund their actual sabotage operations. And this money should be somewhere here in the country to be used to settle accounts with these executors», adds the expert.

Chornyi also notes that by collecting auction-bought debts from Ukrainian companies, Yevseyeva’s company could block their work.

«If «Spectrum Assets» has claims, it can do whatever it wants, for example, go to court and impose seizures on this company’s accounts, thus halting the work of this company, enterprises that may be of interest to Russia», Chornyi explains.

«Spectrum Assets» already does this. Particularly with the assets of «MR Bank» and «Prominvestbank», which it purchased on February 7 at an auction.

In the judicial register, journalists found rulings where «Spectrum Assets», as the legal successor of «MR Bank» and «Prominvestbank», initiates the process of collecting payments on loans from Ukrainian individuals and legal entities for tens of millions of hryvnias.

But does LLC «Spectrum Assets» even have the right to do this?

Journalists found it is prohibited by several regulatory acts.

In March 2022, the Cabinet of Ministers adopted a resolution on protecting national interests, prohibiting Russian citizens and individuals related to them from collecting payments from Ukrainians for loans.

The following month, in May, the National Bank also prohibited Russian citizens from managing non-bank financial institutions in Ukraine – such as «Spectrum Assets».

According to the logic of the National Bank, the owner of the company and Russian citizen Marina Yevseyeva, who also makes managerial decisions, should have appointed a trusted person instead. This person should meet the regulator’s requirements for impeccable business reputation and undergo approval by the National Bank before appointment.

Journalists received from the National Bank a list of financial institutions that completed this procedure and turned to the regulator for approval of the appointment of their new trustees. «Spectrum Assets» is not on this list.

Additionally, to manage auction-bought assets of liquidated or nationalized banks, a financial institution needs an appropriate license from the National Bank.

«Spectrum Assets» has such a license. The National Bank last renewed it in March 2024. The fact that the company belongs to Russian citizen Marina Yevseyeva did not become an obstacle. Although, according to the National Bank’s provisions, Russian citizenship is a sign of an impeccable business reputation, i.e., a reason for license denial.

National Bank of Ukraine

Journalists contacted the National Bank to ask whether they checked for the presence of Russian citizenship in Marina Yevseyeva when they renewed her company’s financial license in 2024 and whether Yevseyeva approached the regulator to appoint a trustee in place of herself in «Spectrum Assets».

The National Bank reported they were unaware of Yevseyeva’s Russian citizenship. In response to the «Schemes» request, it was noted that the package of documents «Spectrum Assets» provided to the regulator repeatedly stated that the company owner is a US citizen not related to the aggressor country, does not reside in Russia, and does not pay taxes there.

«Considering the information received from you, the National Bank sent inquiries to the special-purpose state bodies for information regarding Yevseyeva Marina’s citizenship/tax residency of the Russian Federation» – stated the National Bank in response to the editorial request.

They also noted that if the information about Yevseyeva’s Russian citizenship is officially confirmed, the bank will have grounds to revoke «Spectrum Assets»’s license.

In the Deposit Guarantee Fund, it was reported that if it turns out that the asset buyer concealed their connection with the Russian Federation, they must pay a fine equal to 100% of the lot price and return the acquired assets through the auction.

Journalists called Marina Yevseyeva with questions about why she did not inform the state regulator that she has citizenship of the Russian Federation and why she visited Russia at least six times after the full-scale invasion, while also participating in Ukrainian public auctions.

Upon hearing this question, Yevseyeva silently hung up. Journalists sent her a written request for comment and a list of questions and received the following response:

«"Spectrum Assets" participated in all auctions held in Ukraine in full compliance with Ukrainian legislation, which has been repeatedly checked and confirmed by state authorities».

«I am a citizen of the United States, confirmed by my passport, a copy of which has been repeatedly provided to Ukrainian state authorities. I was born in Kazakhstan and have been residing in the USA for the last 13 years. I officially renounced Russian citizenship», Yevseyeva added in a letter to the editorial office.

However, Yevseyeva did not provide documents confirming her renunciation of Russian citizenship by the publication of this material at the editorial’s request. She also did not explain why her passport and individual taxpayer number of the Russian Federation, according to official state registers, were still valid at the material’s release.

To journalists’ questions about the purpose of her regular visits to Russia after the full-scale invasion, which she made with her valid Russian passport, Yevseyeva also did not respond.

Journalists also contacted her husband, Vladimir Yevseyev, owner of Allrise Capital, with questions about why he and his wife buy assets in Ukraine while holding Russian Federation citizenship passports. As of publication, Vladimir Yevseyev had not responded to journalists’ inquiries.

They also reached out to Mikhail Trubchik. Initially, he told journalists he was ready to communicate via video link, but later informed that he would provide written responses.

In correspondence with journalists, Trubchik commented on the SBU’s suspicions about him: «I have an agreement with the SSU that prohibits me from disclosing any information».

Journalists contacted the SSU to ask if these statements are accurate and are awaiting a response.

Regarding how Trubchik, as the manager of «Spectrum Assets», ensures the company complies with the regulator’s requirements, he replied: «We are confident that we are 100% compliant and all the procedures we’ve started meet the requirements. Our team in Ukraine assumes 100% responsibility and has full voting rights and management».

He also emphasized that he himself and the companies he manages support Ukraine.

Topics: Mikhail TrubchikSSUVladimir YevseyevSpectrum UA Credit LLCFido bankNadra BankLeonid KlimovNelya VoyevchikMarina YevseyevaOksana TerekhovаSpectrum AssetsViktor SubotinProminvestbankSberbank of RussiaMegabankAndriy DerkachDeposit Guarantee Fund of UkraineBankRussia

Comments:

comments powered by DisqusЗагрузка...

Our polls

Show Poll results

Show all polls on the website