Oleg Tsyura: How billions left Ukraine through the "Swiss corridor"

Oleg Tsyura: How billions left Ukraine through the "Swiss corridor"

The name Oleg Tsyura remained in the shadows of the Ukrainian public space for a long time. Unlike prominent figures like Firtash or Martynenko, whom Tsyura served, this "Swiss financier" was not featured on the front pages.

Oleg Tsyura’s biography seems boring: a citizen of Germany and Switzerland, a manager of several European companies, an investment consultant. But behind this façade lies another life: the life of a person whose role in laundering and moving colossal capital is becoming more apparent.

Tsyura’s name surfaced in connection with the case of Dmytro Sennychenko, the former head of the State Property Fund. The investigation estimates the losses from his schemes in the tens of billions of hryvnias. And while Tsyura’s name has not yet appeared in NABU’s materials (at least not officially), journalistic investigations record his involvement in mechanisms without which none of these frauds could have happened. It concerns the systematic export of funds abroad—from factories, mining enterprises, and state corporations to anonymous trusts and accounts in Europe.

Companies linked to Tsyura, primarily the German ITS International Trade & Sourcing GmbH & Co KG, won tenders for the purchase of Ukrainian raw materials under suspiciously favorable conditions. This happened, for example, in 2018, when ITS bought a batch of zirconium ore from SkhidGZK, offering a price only a thousand hryvnias higher than the competitor. The deal value was 45 million hryvnias, so the fact that the auction was formally considered "clean" does not negate that, in essence, a loophole was created to resell the raw materials further—using other schemes and channels.

The key moment came in 2020 when ITS became the intermediary for the supply of ilmenite ore to the "Crimean Titan" plant in occupied Crimea. At that time, the plant was controlled by Dmytro Firtash’s structures and the Lovochkin-Fursin group. For such a deal to occur, it required a person who would ensure not only a legal "wrapper" but also a safe exit of money from Ukraine. Oleg Tsyura performed exactly such a role.

Russian Trace and European Offshores

The withdrawal scheme was built in several levels. The first step was fictitious trade—creating chains of front companies that bought and resold the raw materials with a markup. The second stage consisted of offshore holdings and trusts in Switzerland, where profits and "added value" were withdrawn. The last link became private accounts and investment funds registered to individuals close to Tsyura. It was through such trusts that millions, and then billions of hryvnias, "withdrawn" from Ukrainian state enterprises, settled.

Through his companies, Tsyura also served the interests of Russian business groups. An example is Sergey Gilvarg’s corporation MidUral, for which he organized the supply of ferrochrome through the company Phoenix Resources AG, labeled in documents as Uzbek. Thus, products of Russian origin were legalized in the EU.

No less interesting is the story with Linvo AG. Oleg Tsyura’s wife, Lyudmyla, founded it in 2014, and Tsyura himself led it from 2022 to 2024. This company operated in the interests of St. Petersburg developer Nikolay Korobov, associated with local authorities. In fact, Russian development money was going into Swiss offshores under Tsyura’s control.

Network of Contacts and Clearing Traces

There is an entire network of connections around Tsyura. The first circle—his German companies ITS, associated with Serhiy Bayrak. The second—Russian partners: MidUral and developer Nikolay Korobov. The third—Ukrainian oligarchs, primarily Firtash, Lovochkin, Fursin, as well as mentions of contacts with Martynenko. The fourth—family façades in the person of his wife Lyudmyla and daughter Eva. The fifth—reputational contour: lawyers and digital agencies, which, according to insiders, were involved in clearing information about Tsyura from the internet.

Telegram channels claim that Tsyura spent hundreds of thousands of euros on "reputational cleaning." There are also less confirmed versions—about a fund named after his daughter Eva, where money from Russian clients was deposited, and attempts to use the Turkish corridor to bypass oil sanctions.

Today, Oleg Tsyura’s name is becoming increasingly visible in the context of major Ukrainian corruption cases. His role in withdrawing funds, organizing the bypass of sanctions, and legalizing Russian capitals puts him alongside the most dangerous oligarchs and rulers of Ukraine who have been enriching themselves at the expense of the state for years. It is through such figures that billions left Ukraine, turning into real estate, assets, and accounts in Europe. The question is whether the law enforcement agencies of Switzerland and Germany will manage to uncover his schemes and return what was stolen.

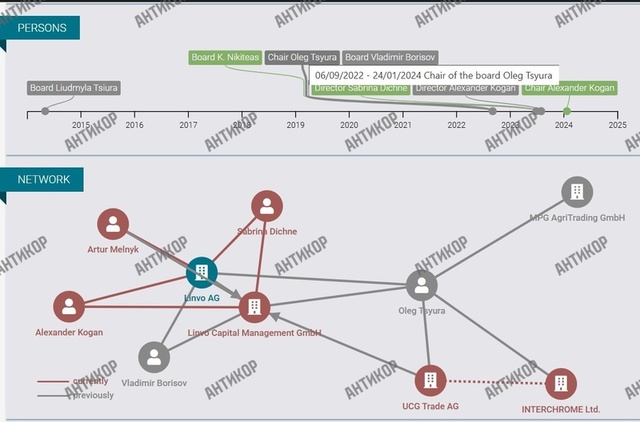

Timeline: How Oleg Tsyura’s Career Evolved

Oleg Tsyura’s story is the story of a gradual transition from a minor financial consultant to a key connection between Ukrainian oligarchs, Russian business, and European jurisdictions.

In the mid-2000s, he appears in Germany’s business registries, holding positions at small companies involved in "trade and asset management." His name then was not associated with large-scale frauds but rather with services for "grey" exporters and small brokers. It was during this period that he established contacts with figures close to Ukraine’s raw materials business.

In the 2010s, there is a transition to larger projects. Through the German structures ITS International Trade & Sourcing GmbH & Co KG and ITS Verwaltung GmbH, Tsyura began working in tandem with Serhiy Bayrak. The first deals with Ukrainian mining and processing plants date back to this time: purchases of zirconium and ilmenite ore, participation in suspicious auctions. Even then, it was not just about trade but also about creating schemes for further profit withdrawal abroad.

2014 becomes a turning point. Tsyura’s wife, Lyudmyla, registers the company Linvo AG in Switzerland. Formally it’s an investment holding, but in fact—an instrument for working with Russian capital, including St. Petersburg developer Nikolay Korobov. During these years, Tsyura strengthens ties with Russian metallurgy, aligning with MidUral corporation.

By 2018, his companies are actively participating in Ukrainian tenders. A characteristic example is the victory at the SkhidGZK auction for zirconium ore. Even then, journalists noted the suspiciously minimal difference in bids. This "playing on the edge" allowed for the legalization of future deals.

2020 brings a high-profile episode with the delivery of 24 thousand tons of ilmenite ore to the "Crimean Titan" plant in occupied Crimea. It is the first case where Tsyura’s name is recorded in conjunction with both Ukrainian raw materials and Russian control over industrial assets.

In 2022–2024, Tsyura himself becomes the head of Linvo AG, through which work with Russian clients continues. At the same time, he obtains Swiss citizenship and, together with his daughter Eva, joins the municipal council of the city of Uitikon. During this time, the clearing of the informational field intensifies: negative publications disappear, and "embellished" biographies and smooth corporate press releases appear on the internet.

2024-2025 is the moment when journalists start bringing Oleg Tsyura’s name into the public sphere. Simultaneously, his partner Sergey Bayrak cooperates with the investigation in the "Sennychenko case." Thus, Tsyura’s figure emerges from the shadow of local deals, transforming into a potential witness or accused in one of Ukraine’s largest corruption processes.

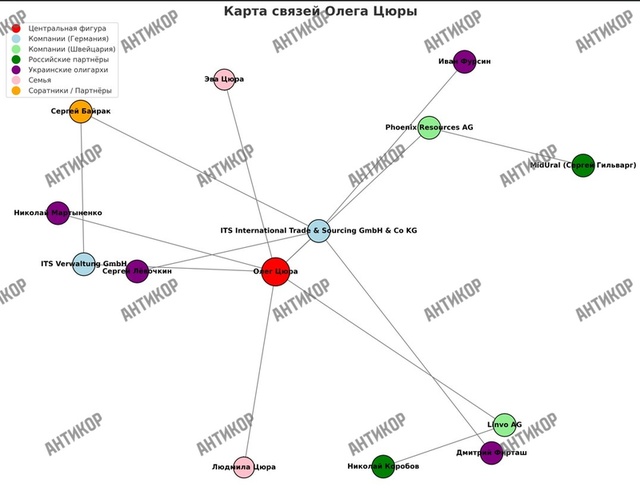

Connections of Oleg Tsyura and What They Mean

To understand Oleg Tsyura’s role, it is important to see not separate deals or companies but his entire network of contacts. It’s a real web, where each node is either a partner, a front company, or a beneficiary.

In the center is Tsyura himself, a citizen of Germany and Switzerland, owner and director of several companies. The first circle around him consists of the structures ITS International Trade & Sourcing GmbH & Co KG and ITS Verwaltung GmbH, registered in Düsseldorf. Formally, they were engaged in trade; in fact, they were associated with Serhiy Bayrak, a person whom NABU considers a key participant in Sennychenko’s schemes. ITS was involved in SkhidGZK tenders and ilmenite deals for the "Crimean Titan" plant.

The second circle—Russian partners. Here, Sergey Gilvarg’s MidUral corporation stands out. For it, Tsyura, through his Swiss company Phoenix Resources AG, organized ferrochrome exports to Europe, substituting the origin of the goods. Another important channel is collaboration with St. Petersburg developer Nikolay Korobov, close to the St. Petersburg authority. His interests in Switzerland were represented by the company Linvo AG, initially founded by Tsyura’s wife Lyudmyla, and later headed by Oleg himself.

The third circle—Ukrainian oligarchs. Here several names are mentioned. Firstly, Dmytro Firtash and his partners Serhiy Lyovochkin and Ivan Fursin, whose structures controlled "Crimean Titan." Without Tsyura’s participation, the supply of Ukrainian ore to Crimea would have been impossible. Secondly, business rumors mention the name Mykola Martynenko, with whom Tsyura is associated through schemes with uranium concentrate.

The fourth circle—familial and personal connections. His wife Lyudmyla, founder of Linvo AG; daughter Eva, who, together with her father, received Swiss citizenship and participates in the municipal council of Uitikon. These figures are not just "family" but also convenient legal façades for registering companies and funds.

Finally, the fifth circle—informative-reputational contour. Here, anonymous digital agencies, Telegram channels, and lawyers appear, who, according to insiders, Tsyura hired to clear information about himself. They ensure the disappearance of negative publications and the creation of the "correct" image of a respectable Swiss.

This map of connections shows the main thing: Tsyura never acted alone. He was not just a manager or consultant but a mediator who connected different worlds—Ukrainian corrupt individuals, Russian businessmen, and Western financial jurisdictions. It is through such figures that billions left Ukraine for offshore accounts, becoming part of a global "gray capital" scheme.

Topics: Ivan FursinYeva TsyuraPJSC Crimean TITANSkhidGZKLinvo AGOffshoreSwitzerlandSerhiy LyovochkinLyudmyla TsyuraPhoenix Resources AGSergey GilvargMidUralMidUral Holding LTDITS International Trade & Sourcing Verwaltung GmbHITS International Trade & Sourcing GmbH & Co.Dmytro SennychenkoNABUDmytro FirtashOleg TsyuraSerhiy BayrakMykola MartynenkoNikolay Korobov

Comments:

comments powered by DisqusЗагрузка...

Our polls

Show Poll results

Show all polls on the website