Tax amnesty for schemes: Head of STS Kravchenko removes hundreds of companies from risk?

Tax amnesty for schemes: Head of STS Kravchenko removes hundreds of companies from risk?

At one of the recent meetings of the NSDC, the head of the STS Ruslan Kravchenko reported that the priority direction of his work is reducing pressure on businesses due to the blocking of tax invoices and classifying enterprises as "risky".

He even mentioned the number – 5,700 enterprises were removed from the risky category just in January 2025.

At the same time, Kravchenko emphasized that the removal of companies from the risky category would not affect those enterprises that evade paying taxes and are involved in optimization. On the contrary, pressure on such entities will only increase.

It sounds traditionally beautiful, but upon closer analysis, the opposite is true: Kravchenko is removing precisely the scheming companies from the risky category.

Here’s an example - LLC "ABK Dnipro".

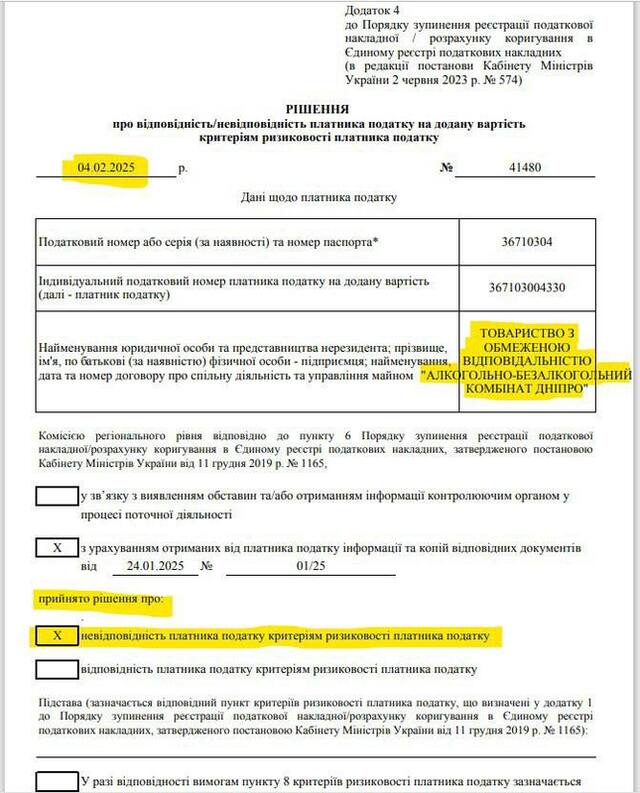

On February 4, 2025, by decision No. 41480, the STS removed LLC "ABK Dnipro" (USREOU code 36710304), located in the village of Tsarychanske, Dnipropetrovsk region, from the risky list.

This decision shocked both law enforcement and industry players.

For several years, this alcohol producer has been known as one of the most brazen and toxic producers of surrogate products using Form F2. It has been under the close scrutiny of both the tax authorities and law enforcement for a long time.

They have lost their license, faced regular searches and inspections, and are subjects of criminal proceedings, among other things.

Due to the collective risks in evading taxes exceeding 1 billion UAH in just the last three years, the STS categorized LLC "ABK Dnipro" as risky.

Meanwhile, active investigative actions regarding their production were taking place simultaneously with Ruslan Kravchenko’s decision to remove them from the risky category.

Facts

In December 2024, within the framework of proceeding No. 72024001210000006, the BEE conducted investigative actions on the territory of the LLC "ABK Dnipro" factory at the address: Tsarychanka, Tsarychanska St., 168.

At that location, during nighttime hours, workers of LLC "ABK Dnipro" were discovered making illegal alcohol products on the bottling line at the time the search began:

- Cognac "Dnipro" – under the guise of the product of LLC "Oleksandriia-Blih", without excise tax stamps.

- Bottling alcohol in plastic containers of 6 liters labeled "Sebeck Water" from the manufacturer PE "Chuhuivskyi Mineral Water Plant".

- Seized

- over 6,000 liters of unaccounted-for alcohol;

- bottling line components for alcohol products;

- over 1,000 bottles of illegally produced cognac "Dnipro" from LLC "Oleksandriia-Blih" without excise tax stamps;

- over 300 plastic 6-liter containers with liquid smelling of alcohol and labeled "Sebeck Water" from PE "Chuhuivskyi Mineral Water Plant";

- 72 bottles of vodka "Ambasadoriu Premium" from LLC "ABK Dnipro" without excise tax stamps;

- rough notes with the volumes of unaccounted excise goods and other evidence.

Here’s how the classic raid looks – and remember, this was December 2024.

What happened next?

A month and a half later, on February 4, 2025, the tax authorities unexpectedly removed LLC "ABK Dnipro" from the risky companies list.

And just three days later, on February 7, 2025, the BEE conducted new raids – and found the same situation again.

During the new search, the following were discovered and seized:

- over 3,600 bottles of counterfeit alcohol products without excise stamps (brand "Petrykivska", producer according to labels – LLC "ABK Dnipro");

- 19,000 liters of alcohol;

- a bottling line for alcoholic products;

- facilities for producing alcohol without excise stamps.

Photos are also published.

Vivid, isn’t it?

Right during the investigative actions, when law enforcement seizes tens of tons of counterfeits and illegal alcohol, the tax office of Ruslan Kravchenko ceases to see any of it.

They classify the producer as "white and fluffy" and even report this to the NSDC as a success.

If this isn’t the "commercialization" of the new tax team, then what is?

Topics: LLC Oleksandriia-BlihLLC ABK DniproState Tax ServiceIllegally producingIllegal businessRuslan Kravchenko

Comments:

comments powered by DisqusЗагрузка...

Our polls

Show Poll results

Show all polls on the website