Ukrainians are buying up currency: Banks have set a new record for importing cash dollars

Ukrainians are buying up currency: Banks have set a new record for importing cash dollars

Banks have set a new record for the import of cash dollars - Ukrainians fear hryvnia devaluation and are buying up currency.

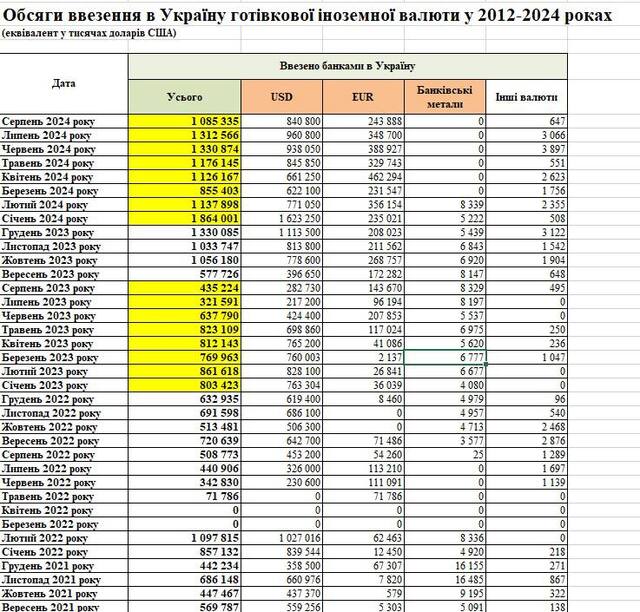

Ukrainian banks sharply increased the import of foreign cash into the country, as reported by the National Bank. In the first 8 months of 2024, the total volume of imports grew 1.8 times compared to the same period in 2023, reaching $9.9 billion. If compared to the pre-war period, January - August 2021, the import of banknotes has skyrocketed 4.6 times from $2.1 billion.

More than the mentioned $9.9 billion, our banks imported in the first 8 months back in the distant 2012 year - bringing in dollars/euros and other foreign currencies worth $11.4 billion.

The majority of the imported foreign cash into Ukraine in the first 8 months of 2024 is dollars. They account for 73.5% of the total volume. Euros come in second place (26.3%), followed by gold (0.1%), Polish zloty (0.09%), and British pound sterling (0.05%). Bank metals are considered currency values.

The growing import of foreign cash is explained by the strengthening devaluation sentiments among Ukrainians and, accordingly, increased demand for dollars and euros from the population.

«It’s no secret, so much that the growth of devaluation sentiments among citizens is confirmed in their official reports by the National Bank. They already recognize the fact of converting hryvnia deposits into foreign currency after their terms expire. If earlier people agreed to leave at least part of the dollars/euros in the account, now they increasingly want to get foreign cash and take it out of the bank. Bank managers have stopped convincing them to invest in hryvnia, as they are not listened to, and remind about the falling hryvnia rate since the NBU abandoned the fixed rate regime», — explained a deputy chairman of the board of one of the systemic banks.

After abandoning the fixed official rate of 36.6 UAH/$ in October 2023, the NBU raised the dollar to 41.17 UAH/$ as of today, September 30. In almost a year, the national bank’s hryvnia rate has depreciated by 12.5%. Meanwhile, the average nominal yield of 12-month deposits in banks currently stands at only 13.18% per annum, and the real yield (after deducting 19.5% taxes — 18% personal income tax and 1.5% military levy) is only 10.6%. It does not cover even the current depreciation. And it is not certain it will cover the future one. After all, Ukrainian authorities stated that the state budget-2025 is calculated at an average yearly rate of 45 UAH/$ — this means a planned further depreciation of the hryvnia by another 9.3%. In addition, Ukraine plans to increase the military levy from 1.5% to 5%, the Verkhovna Rada has passed the corresponding changes in the draft law No. 11416-d in the first reading. This will reduce real rates (after tax deduction) on hryvnia deposits from the current 10.6% to 10.1%.

Bankers predict an increase in the supply of foreign cash to Ukraine in the coming months. They note that people are very quickly buying up current cash supplies and depleting the available dollars/euros on the domestic market. This is confirmed by the official reports of the National Bank, which show the following volumes of foreign currency cash sales to individuals:

• 8 months of 2024 — $16.2 billion (with an import of $9.9 billion);

• 8 months of 2023 — $11.9 billion ($5.5 billion);

• 8 months of 2022 — $6.6 billion ($3.3 billion);

• 8 months of 2021 — $12.3 billion (with an import of $2.1 billion).

That is, in 2024, the population increased cash purchases by 36% compared to 2023.

Topics: NBUCashDollarBank

Comments:

comments powered by DisqusЗагрузка...

Our polls

Show Poll results

Show all polls on the website