Andriy Brodskyi went all out

Andriy Brodskyi went all out

The Titanium Baron from Dnipro has extended the legal series with his main creditor for a new season

The disputes between PJSC "Joint-Stock Commercial Industrial-Investment Bank" (Prominvestbank) and LLC "Production and Commercial Firm "Velta" of businessman Andriy Brodskyi over an unpaid loan amounting to about $100 million have entered a new round. Last week, the Kyiv Commercial Court accepted for consideration a lawsuit by "Velta" against Prominvestbank regarding amendments to the loan agreement signed in 2011. If the debtor fails to provide sufficient arguments to the court, the production complex for the extraction and enrichment of titanium raw materials, built by VCF "Velta" in the Kirovohrad region, will become the property of the Russian Vnesheconombank’s subsidiary.

Considering the amendments to the loan agreement from September 14, 2012, the bank issued Brodskyi’s company a total of over $93.3 million. Of this, $34.1 million was directed towards repaying the debt to Ukrgazbank for a previously obtained loan, $15 million for refinancing the debt to Prominvestbank itself, $2 million for replenishing working capital, another $27.6 million for capital investments in the construction of the first stage of the enrichment production with a capacity of 185,000 tons of ilmenite concentrate per year, and $14.8 million for increasing production to 300,000 tons.

To secure the loan, the borrower mortgaged Prominvestbank the core production assets and committed to selling products exclusively through the bank. According to the business plan, "Velta" was supposed to repay the loan in 2016. However, the mining and processing plant did not reach the projected capacity, and in October 2014, the first stage of the titanium raw materials enrichment complex, located in the village of Korobchyne (Novomyrhorod district, Kirovohrad region), was almost completely destroyed by a five-hour fire. Law enforcement agencies concluded that the arson was deliberate, but neither the perpetrators nor the clients were identified.

After the fire, Brodskyi’s company began seeking amendments to the loan agreement signed with Prominvestbank in courts to defer debt payments. At Velta’s request, the court prohibited the bank from demanding interest and penalty fees for the overdue debt from the company.

The proceedings dragged on for several years until, in April 2018, the Supreme Court of Ukraine reviewed Prominvestbank’s cassation appeal against the decisions of the Kyiv Commercial and Appellate Commercial Courts, which provided for the deferment of the debt repayment by "Velta" until July 1, 2021.

In the photo – Andriy Brodskyi

During the proceedings, the parties attempted to reach a pre-trial settlement, but the Supreme Court ultimately concluded that Andriy Brodsky’s company was delaying the case, and granted the bankers’ cassation. The Supreme Court overturned the previously issued verdicts in favor of "Velta" and sent the case to the commercial court of Kyiv for a new review. The results could significantly disappoint Andriy Brodskyi.

After all, when the case reached the Supreme Court, it turned out that "Velta" had gotten itself into a credit trap, signing amendments to the loan agreement No. 20-2870/2-1 ten months after the fire, according to which the final loan repayment date was postponed from December 31, 2020, to January 30, 2016. According to the bank, the case materials include conclusions from a forensic economic examination from 2017, which established that "Velta" delayed funding the production restoration using the insurance compensation in 2016, leading to a delay in restoring the burned down first stage of the mining processing plant (Brodskyi’s representatives claim they were compensated only 44% of the damage value). In addition, the bank does not consider "Velta" a conscientious borrower since the company selectively settles with creditors.

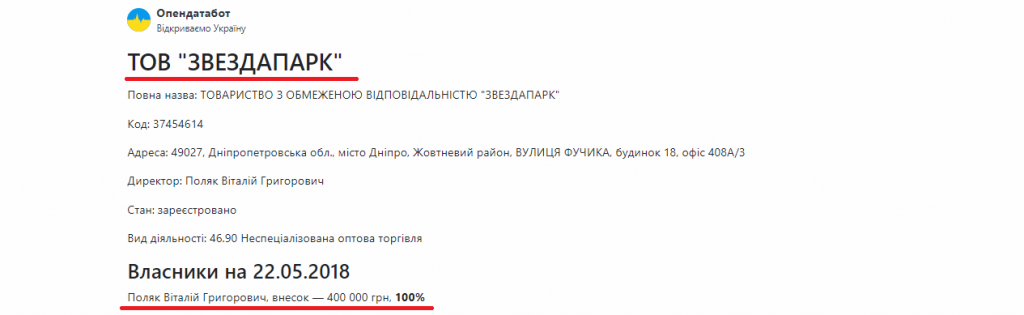

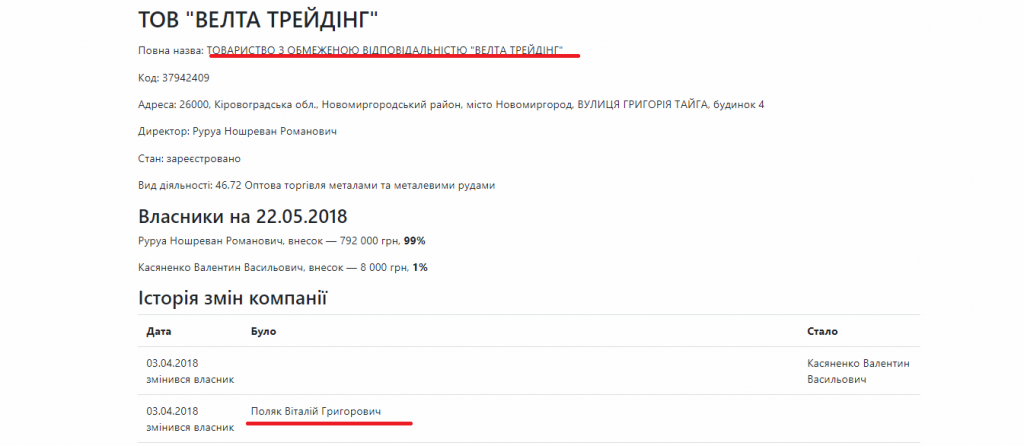

While denying Prominvestbank the return of loan interest, Brodskyi’s company in February 2017 concluded a settlement with another Dnipro company, LLC "Zvezdapark", to which it owed over 45 million UAH. Acknowledging the debt in full, "Velta" committed to repaying it in 11 installments, transferring over 4 million UAH to "Zvezdapark" every month. Notably, "Zvezdapark" is registered to some Vitaliy Polyak, who was recently listed among the founders of the company "Velta Trading".

Apparently, the recent application by "Velta"’s parent company – Velta Group Global – about plans to start building a titanium dioxide plant in the Mishor Rotem industrial park (Israel) in 2019 is also pushing Prominvestbank towards debt recovery. The cost of this project is around $150-200 million, and even if Brodsky manages to obtain benefits from Israel under the investment support legislation, it is obvious that settling with Prominvestbank will not be a priority for him in the coming years.

Topics: Velta Group GlobalLLC ZvezdaparkVitaliy PolyakUkrgazBankAndriy BrodskyiVeltaProminvestbank

Comments:

comments powered by DisqusЗагрузка...

Our polls

Show Poll results

Show all polls on the website